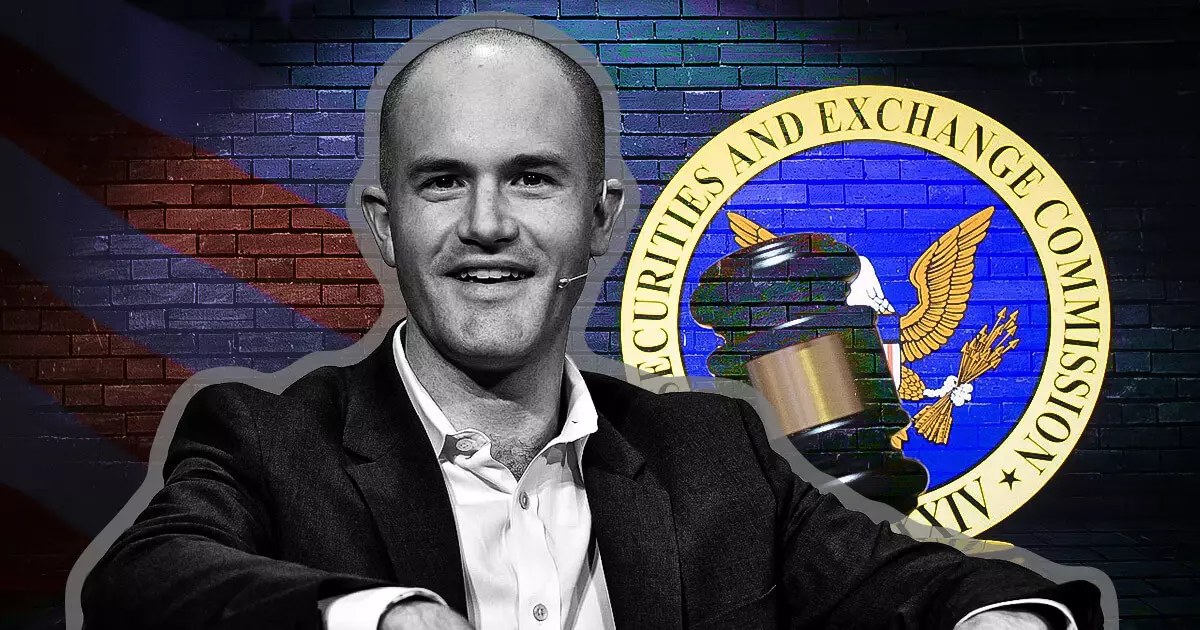

In a recent declaration that underscores the ongoing friction between the cryptocurrency industry and regulatory bodies, Coinbase CEO Brian Armstrong declared that the exchange would terminate collaborations with law firms that employ former regulators who participated in what he considers detrimental enforcement actions against the crypto sector. Armstrong’s pronouncement, made public on December 3, has piqued interest, especially in light of former SEC Division of Enforcement Director Gurbir S. Grewal’s new position at Milbank’s Litigation & Arbitration Group. This strategic decision reflects more than just corporate policy; it signals a broader resistance to what many in the crypto community perceive as unjust regulatory practices.

Armstrong’s firm stance reveals a significant shift in how cryptocurrency businesses view their relationships with the legal community. He explicitly stated that Coinbase would distance itself from any law firm that hires individuals engaged in regulatory actions he deems harmful to the industry. By calling out Milbank explicitly, he highlighted an area of contention that could instigate further debate around the ethical responsibilities of former regulatory officials when they transition to private-sector roles.

During his announcement, Armstrong did not shy away from directly criticizing senior partners at law firms, whom he accused of lacking awareness about the nuances and challenges faced by the crypto industry regarding regulatory frameworks. He directed pointed criticism at Grewal, alleging that his actions during his SEC tenure had an unjust impact on crypto businesses. Armstrong articulated that the prior administration of the SEC, particularly under Gary Gensler, orchestrated a campaign that constrained the growth and innovation within the digital asset space without offering transparent compliance guidelines.

The assertion of ethics violations by such regulatory actors sheds light on the growing displeasure within the crypto ecosystem. Armstrong’s remarks imply that the SEC’s enforcement strategies are not merely a product of strict regulatory oversight but part of a larger narrative that arguably seeks to undermine a burgeoning technology sector.

Armstrong’s call for the crypto industry to cease financial support for individuals linked to unfavorable regulatory actions indicates a strategic recalibration in partnerships and alliances. He encourages other firms to communicate their discontent through financial means, advocating for an industry-wide stance against those he claims play a role in hindering crypto innovation. This initiative not only aims to protect the industry’s interests but also seeks to instigate a broader cultural change regarding the treatment of regulatory professionals who step into influential private sector roles post-tenure.

As Milbank and similar law firms grapple with this ultimatum, the repercussions could be long-lasting. Although Milbank has yet to respond to Armstrong’s statement, the potential for a rift in established legal relationships with major players in the crypto market could compel law firms to reassess their hiring practices and align their interests more closely with the evolving demands of the digital asset space.

Ultimately, Armstrong’s declaration casts a spotlight on a significant tension point between regulators and the burgeoning crypto industry. The ongoing legal strategies employed by Coinbase and others indicate a pivotal moment where digital asset businesses are prepared to take a stand against regulatory practices that they perceive as harmful. As the industry matures, the relationship between regulation and innovation will likely continue to be a central theme, highlighting the need for dialogue, transparency, and mutual understanding between crypto ventures and regulatory bodies. The path forward hinges on whether both sides can find a balance that fosters growth while maintaining necessary oversight.