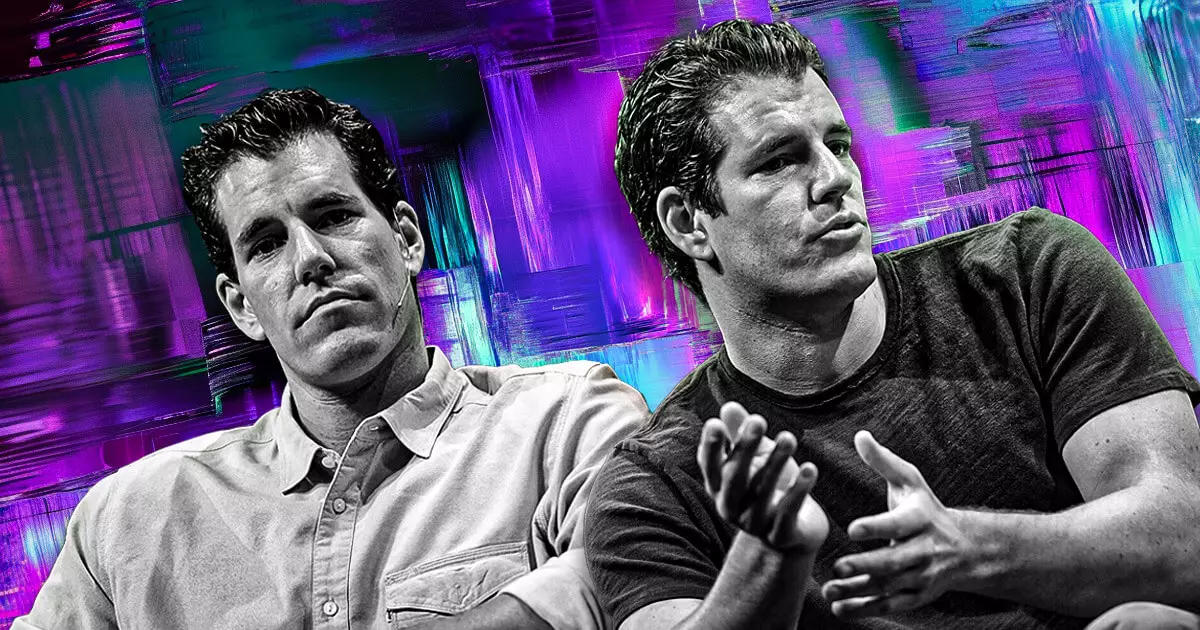

The financial sector is experiencing a seismic shift, particularly with the entry of cryptocurrency exchanges into the public market. Gemini, the brainchild of Cameron and Tyler Winklevoss, is all set to challenge traditional financial norms by filing a draft for an initial public offering (IPO) with the US Securities and Exchange Commission (SEC). This move is not just a routine step; it is a declaration of confidence in the future of digital assets, signaling that major players are ready to claim their stake in this evolving industry.

Market Conditions Favoring Digital Asset Companies

Recent discussions around Gemini’s IPO highlight an intriguing moment in time. As the landscape becomes increasingly friendly toward digital finance, we may witness a wave of initial public offerings from cryptocurrency firms. The favorable sentiment emanating from the White House can be pivotal; a pro-digital asset administration only amplifies the allure for exchanges like Gemini to enter the market. While regulations are still being ironed out, many firms are eager to follow in Gemini’s trailblazing footsteps.

Circle’s Success as a Catalyst

Gemini’s IPO filing coincides with Circle’s recent debut on the New York Stock Exchange (NYSE). The trajectory of Circle shares—a meteoric rise from an initial offering price to exceeding expectations on the first day—serves as an example and a potential blueprint for Gemini and others. Such successes drive investor enthusiasm, indicating that public sentiment can be overwhelmingly positive if companies can demonstrate profitability and market viability. If Circle’s performance is any indication, investors are ready to flock to publicly traded digital assets.

The Pressure to Perform

However, Pebbles may not always be smooth for Gemini. Like any company entering the public sphere, they face significant scrutiny and must tread carefully. Analysts emphasize that a strong response to SEC feedback and robust financial performance will be crucial for any successful launch. Failure to engage effectively with regulators can lead to delays, and the company cannot afford to work in a vacuum.

Competition Heats Up

Other platforms, such as Kraken, are reportedly preparing for their IPOs, buoyed by the same positive environment. This pre-launch competition means Gemini must not only perform well but do so faster than its peers. The stakes are high, and while camaraderie exists among crypto firms, there is an underlying urgency to emerge as leaders in this transformative phase.

The Center-Right Perspective: A Balanced Outlook on Financial Innovation

As a center-right commentator, I find the potential of Gemini’s IPO both exhilarating and troubling. The expansion of digital asset exchanges into the public marketplace could redefine investment paradigms. But we must also remain vigilant. Innovation should not bypass the critical oversight that ensures market stability and protects investors. A balanced approach combining encouragement for growth with regulatory caution is essential.

In a world where financial innovations run rampant, Gemini’s move may very well become a hallmark of where we’re headed—if we navigate it wisely.