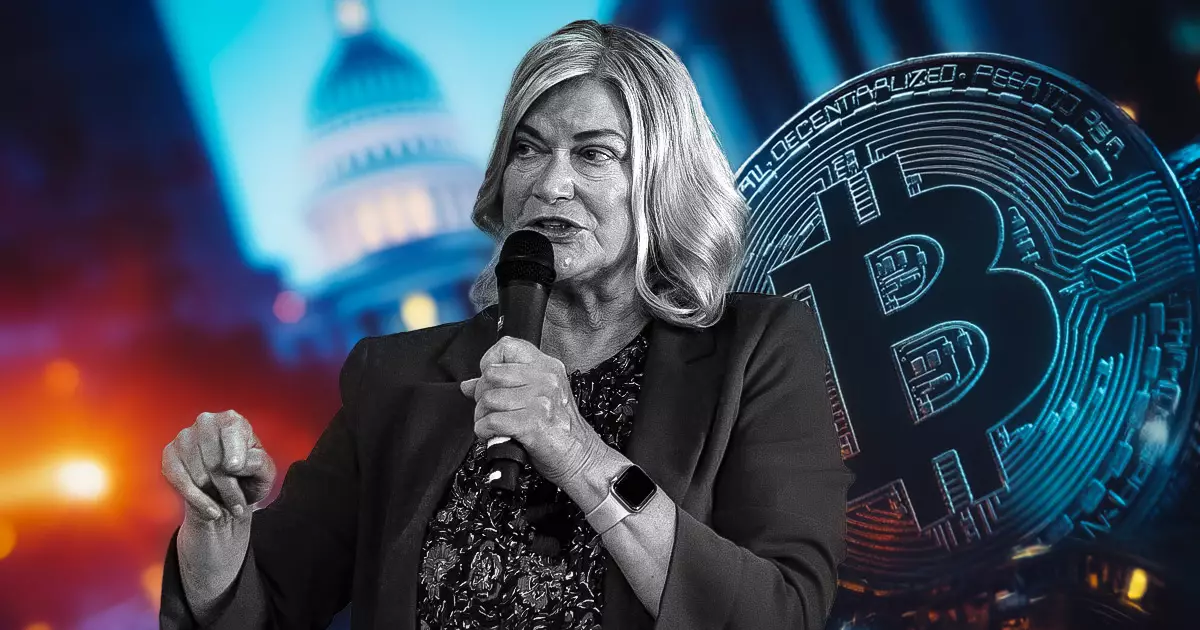

The recent legislative effort spearheaded by Senator Cynthia Lummis signals an ambitious move to reshape how cryptocurrencies are taxed in America. With a comprehensive rewrite of internal tax code provisions, this bill aims to bring clarity to a murky legal domain that has left many traders, investors, and institutions in legal limbo. Its central promise—cutting through bureaucratic red tape—is perhaps overly idealistic, masking deeper concerns about government overreach and potential stifling of innovation. By defining “digital asset” explicitly and establishing rules for actively traded assets, the bill introduces a framework that could serve as both a guideline and a trap for market participants. In particular, the provision that exempts certain small transactions from reporting requirements might seem beneficial on the surface, but it raises questions about whether it encourages tax compliance or fosters a shadow economy. The government’s attempt to index dollar caps for inflation after 2026 is a recognition of ongoing economic shifts, yet it remains to be seen how effectively these measures will deter tax evasion while supporting growth. Ultimately, the bill’s attempt to streamline regulations risks pushing too far toward control, threatening the decentralized ethos that underpins the entire crypto movement.

An Attack on Transparency or a Necessary Reform?

At the core of this legislation is a debate about transparency versus privacy—a fundamental issue for many crypto enthusiasts who value financial sovereignty. The bill’s requirement for dedicated books, wallets, or accounts is a double-edged sword. On one hand, it aims to provide clarity that might attract institutional players and foster public trust. On the other hand, it could impose invasive reporting obligations, making privacy a casualty of overly elaborate compliance demands. The inclusion of new safe harbors, especially the expanded securities-lending provisions covering actively traded tokens, exemplifies a pragmatic approach that recognizes crypto’s evolving workhorse role. Still, allowing holders to loan tokens without triggering recognition events might unintentionally fuel tax avoidance strategies, undermining the government’s revenue base. The introduction of mark-to-market accounting—an established accounting principle in other markets—could revolutionize crypto trading, simplifying some aspects but potentially creating new avenues for manipulation. With these sweeping changes, the bill balances precariously on the edge of encouraging legitimate growth while risking forays into regulatory overreach that could hamstring innovation and drive activity underground.

The Future of Crypto and Government Control: A Double-Edged Sword

Perhaps the most controversial aspect of this legislation is its sunset clause—most provisions set to expire after 2035. This temporary nature suggests a recognition that the crypto industry is still evolving and that regulations must remain adaptable. However, it also hints at a profound uncertainty about the long-term direction of federal oversight. The stipulation that income from block validation isn’t taxed upon receipt, along with the ability for miners and stakers to recognize income only upon sale, could significantly influence how the industry develops in the coming decades. Simply put, this legislation navigates a fine line between supporting innovation and exerting control—an effort, arguably, to shape the rapidly changing landscape of digital assets to fit within traditional tax frameworks. While it offers some relief and opportunities for charitable deductions, it simultaneously risks creating a regulatory environment that favors established players while marginalizing smaller, innovative actors that thrive on privacy and flexibility. If enacted, this bill may define the future of crypto in America, either as a catalyst for growth or a mechanism for government oversight entrenched in a carefully designed trap.