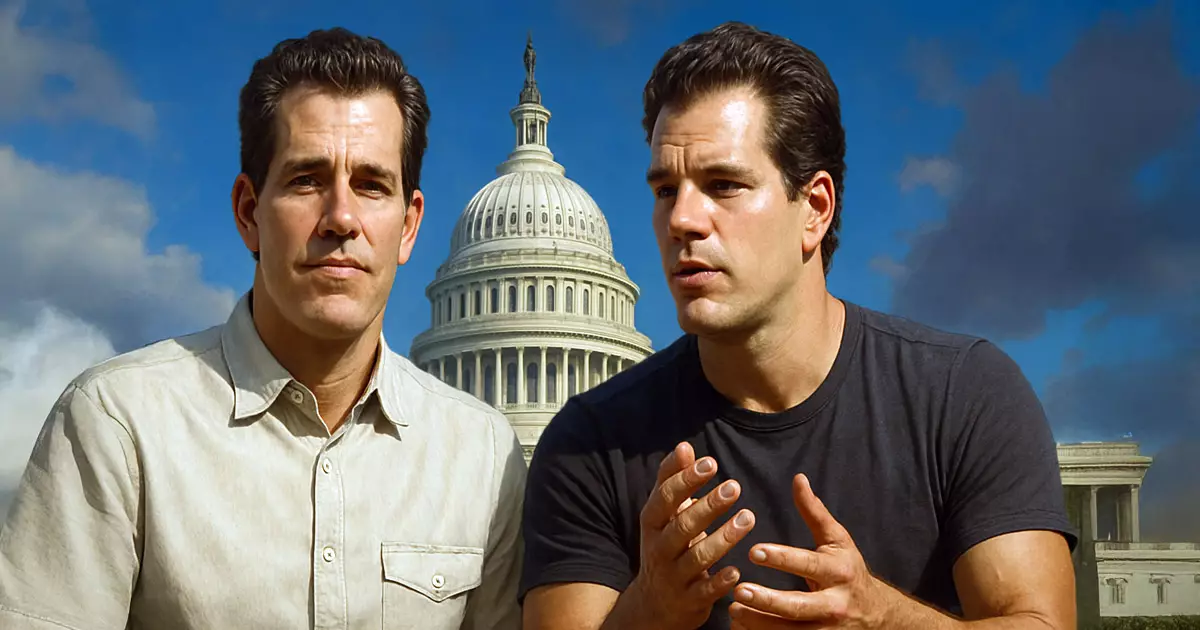

The recent infusion of $21 million in Bitcoin from the Winklevoss-led Digital Freedom Fund PAC signals an unmistakable shift in how the crypto industry seeks to influence American politics. Far from a mere gesture of financial muscle, this move embodies a strategic effort to embed digital assets into the fabric of governance and policy. It underscores a pivot from the free-market advocacy traditionally associated with conservatives towards an ideological stance that champions technological sovereignty and individual financial freedom against the encroachment of centralized authorities. This aggressive investment is designed to promote legislation that frames crypto not merely as an asset class but as a pillar of American innovation—an essential component of economic independence and national sovereignty in the digital age.

Yet, this audacious campaign raises questions about the sustainability of unregulated growth within such a volatile industry. The Winklevoss brothers seem to suggest that crypto—particularly Bitcoin—can serve as a counterpower to government overreach, provided it receives policy backing. They envision a future where blockchain technologies flourish uninhibited by bureaucratic drag and overregulation. This stance resonates with their broader political vision: a conservative-leaning yet innovation-friendly America, where entrepreneurial spirit and technological prowess are protected from bureaucratic hurdles. However, history suggests that unrestrained market freedom in finance often invites chaos and systemic risk, especially when poorly understood or improperly policed—as evidenced by previous financial upheavals.

Their move marks a pivotal moment: a calculated gamble that crypto assets can catalyze a political shift, moving us closer to an era where decentralized finance becomes a legitimate avenue of power. It is a bold challenge to the growing influence of government-backed digital currencies and centralized financial systems. This approach hinges on the belief that with the right legal safeguards—such as the proposed “Crypto Bill of Rights”—the United States can become a leader in the burgeoning crypto landscape, even at the expense of tightening the regulatory noose on traditional financial institutions.

Strategic Ambitions: Legislation and Ideology in Play

At the core of the Winklevoss strategy is a nuanced legislative agenda crafted to shield entrepreneurs and users from regulatory overreach. Their “Skinny Market Structure Bill” aims to craft a delicate balance—promoting innovation while avoiding crippling bureaucratic interference. Central to this vision are legal protections akin to Section 230 of the Communications Decency Act, which has historically provided immunity to online platforms. Extending similar protections to code writers and blockchain developers could be instrumental in fostering an environment where innovation thrives, rather than being stifled by fear of legal consequences.

Furthermore, their opposition to Central Bank Digital Currencies (CBDCs) is rooted in ideological beliefs about individual liberty and privacy. Framing CBDCs as “totalitarian technologies” reveals a suspicion that government-controlled digital currencies could facilitate unprecedented levels of financial surveillance and control. Such skepticism is understandable from a center-right perspective that prizes personal autonomy but risky if it hampers pragmatic regulatory measures designed to secure the financial system against abuse or fraud. The push for open banking, payment protections, and rulemaking transparency reveals an underlying desire to create a transparent, competitive landscape—one where small startups can compete on equal footing with entrenched financial giants.

The PAC’s embrace of initiatives like those of SEC Chairman Paul Atkins and CFTC Acting Chairman Caroline Pham signals a strategic desire to shape crypto regulation from within the existing institutional framework. This reflects a pragmatic acknowledgment that regulatory capture is a real threat—yet, paradoxically, it also risks reinforcing the power of large industry players if not carefully tempered. The Winklevoss vision is clear: create a regulatory environment that champions innovation and prevents government overreach but still maintains the integrity and stability of financial markets.

Political Implications and the Future Outlook

This billionaire-backed crypto campaign underscores a broader ideological push: to preserve what they see as the “American Golden Age,” fueled by technological dominance and free enterprise. Their focus on supporting candidates who champion Trump’s crypto agenda is a calculated move to influence policy at pivotal moments. The goal is not just to protect digital assets but to shift the political landscape, ensuring that the industry remains aligned with their vision of economic independence and technological sovereignty.

However, this gamble also introduces substantial risks. The volatility inherent in cryptocurrencies, coupled with the political polarization in Washington, presents an uncertain environment for long-term policy success. Promoting crypto-friendly legislation while resisting regulatory frameworks that might stabilize or contain the industry could ultimately backfire—either attracting punitive crackdowns or fostering speculative bubbles. Yet, in the center-right worldview, the emphasis remains on fostering an environment where crypto can serve as a shield against government overreach, rather than a tool for reckless speculation or systemic risk.

The move by the Winklevoss brothers reflects a deeper conviction: that the future of America’s economic power hinges on technological innovation and a robust, decentralized financial system. Whether this bold financial injection and ideological positioning will catalyze the intended political shift remains to be seen, but it undeniably signals a seismic shift in the intersection of money, power, and policy in modern America.