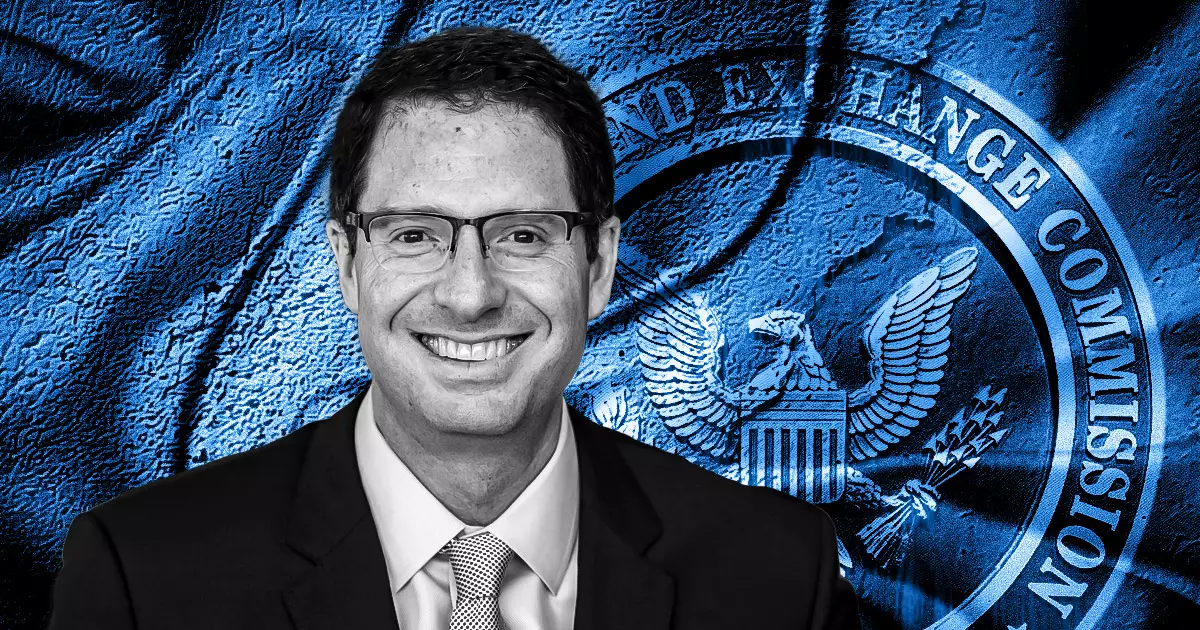

In the dynamic realm of cryptocurrency and financial regulation, Brian Brooks has recently emerged as a noteworthy contender for the position of Chair of the Securities and Exchange Commission (SEC). Prominent figures, including Jesse Powell, the founder of the Kraken exchange, are publicly endorsing Brooks, emphasizing his comprehensive understanding of both the cryptocurrency landscape and the broader regulatory framework that governs U.S. financial markets. This growing support reflects a significant shift in the conversation around cryptocurrency regulation, indicating a desire for leadership that is not only well-versed in traditional finance but also adept at navigating the complexities of digital assets.

Powell’s comments also draw attention to the perceived shortcomings of the SEC under its current leadership. He argues that the agency has strayed from its foundational purposes, leading to detrimental outcomes for American businesses and investors. This sentiment resonates with many in the crypto community, who have long voiced concerns over the SEC’s enforcement strategies and regulatory clarity—or the lack thereof. Such critiques highlight a critical juncture for the SEC, suggesting that a leadership change could facilitate a more accommodating environment for cryptocurrencies and blockchain technology.

Brooks’ candidacy is particularly intriguing given his extensive background in both the public and private sectors. Having served as the acting US Comptroller of the Currency, he oversaw significant advancements in financial regulations that positively impacted the digital asset space, such as allowing national banks to offer custodial services for cryptocurrencies. Given this precedent, his potential appointment could herald a new era where regulators consider the specific needs of emerging technologies rather than imposing blanket policies that stifle innovation.

Additionally, Brooks is not the only name in the running to succeed Gary Gensler as SEC Chair. The field of potential candidates includes seasoned professionals such as Dan Gallagher from Robinhood and SEC Commissioner Hester Peirce, known affectionately as “Crypto Mom.” Each of these figures brings unique perspectives and experiences, but Brooks’ strong focus on digital currencies may provide him with an edge, particularly in a regulatory environment that increasingly recognizes the significance of cryptocurrencies.

In recent statements, Brooks has expressed that any new leadership at the SEC will be inheriting a pivotal framework laid down during the Trump administration—where measures supporting decentralized finance were initiated. He argues that this foundation sets the stage for future regulatory advancements that could strengthen the U.S.’s position in the global crypto arena. By advocating for a regulatory landscape that embraces digital assets rather than stifles them, Brooks could spearhead a transformation in how the SEC interacts with innovative financial technologies.

As discussions about the future of the SEC continue to unfold, Brian Brooks stands at the forefront of a movement advocating for more progressive and accommodating cryptocurrency regulations. Amidst a backdrop of shifting government philosophies and an evolving financial landscape, the possibility of Brooks taking the helm offers promise not just for the crypto sector, but for financial markets as a whole. Whether Brooks will ultimately be appointed remains to be seen, but his candidacy certainly signals a growing recognition of the need for evolution within one of the most important regulatory bodies in the United States.