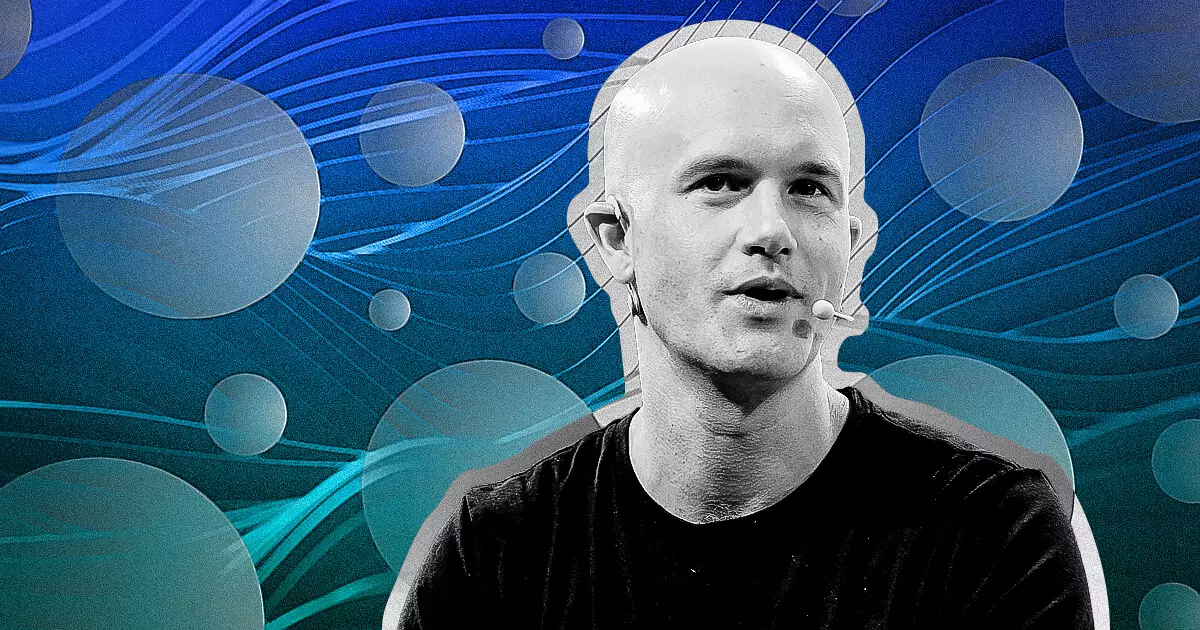

In an era marked by digital transformation and the rapid evolution of the cryptocurrency sector, the complexity and variety of new tokens emerging in the market are increasingly difficult to navigate. Recently, Brian Armstrong, CEO of Coinbase, underscored the urgency for a comprehensive reevaluation of the token listing process. In a social media address on January 26, Armstrong highlighted the surge of new cryptocurrencies attributed to blockchain advances and user-friendly platforms, enabling anyone to create new tokens. This scenario has resulted in an overwhelming average of one million new tokens generated weekly—a fact that raises fundamental questions about the viability and efficiency of traditional assessment protocols.

The sheer volume of tokens introduces immense pressure on existing regulatory frameworks, which have been primarily designed for a more stable and less dynamic market environment. The rapid proliferation of digital assets, fueled by groundbreaking technological innovations and simplified access to blockchain tools, has created a landscape that is unrecognizable compared to just a few years ago. Armstrong’s insights serve to illustrate the fundamental shift in how we must perceive and manage digital currencies and their corresponding systems.

Armstrong’s critique of conventional token evaluation processes is stark. The current methodologies often rely on centralized approval systems where each token is assessed on a one-by-one basis. As a result, there is a lag between new token creation and the ability to adequately evaluate these assets, which could pose risks to investors and the overall market. The call for change stems from the acknowledgment that such traditional systems are neither efficient nor scalable in this new paradigm of burgeoning digital assets.

To address these concerns, Armstrong advocates for the implementation of a block-list system, which would allow all tokens to be recognized as accessible by default unless flagged for potential harm. This transformative approach shifts the burden of evaluation from a centralized authority to a decentralized feedback mechanism, encompassing user reviews and automated data scans on the blockchain. By adopting this strategy, Armstrong envisions a more responsive system that builds trust among users while facilitating a more scalable and efficient token management process.

Armstrong’s comments extend beyond the operational difficulties of token management; they also encompass a critical examination of regulatory frameworks. He made it clear that existing regulations are inadequate for dealing with the innovative pace of the cryptocurrency industry. Armstrong emphasized the need for regulatory bodies to embrace adaptability, arguing that the traditional metrics of compliance and approval cannot keep up with the relentless evolution of blockchain technology.

A collaborative effort between the regulatory sector and cryptocurrency innovators is vital to outline new frameworks that ensure investor protection while fostering an environment conducive to innovation. Armstrong insists that regulatory innovations are essential, noting that both public and private sectors must work together to develop solutions that can safeguard participants in this fast-growing ecosystem.

In addition to advocating for improved token listing processes and regulatory adaptations, Armstrong reiterated Coinbase’s commitment to integrating decentralized exchanges (DEX) more deeply into its platform. This dual approach presents an opportunity to unify centralized (CEX) and decentralized trading under a single, streamlined platform. Such integration aims to simplify the user experience, allowing traders to transition between different types of exchanges without the complexities usually associated with managing multiple platforms.

Armstrong elaborated on this vision, explaining that making decentralized trading as intuitive and accessible as centralized platforms would empower users and broaden the crypto user base. By eliminating the barriers that differentiate DEX from CEX, Coinbase is poised to play a pivotal role in harmonizing the diverse crypto ecosystem, thus setting a standard for the rest of the industry.

Armstrong’s statements not only reflect a pressing need for systemic changes in how we approach token listings but also highlight a broader theme of sustainable innovation throughout the cryptocurrency industry. As technological advancements continue to reshape the digital landscape, embracing new operational and regulatory frameworks becomes imperative. Coinbase’s initiatives could very well dictate the future trajectory of the crypto market, positioning the exchange as a model for others to emulate in navigating the complexities of this rapidly changing domain. The dialogue Armstrong has initiated is an essential step forward towards building a transparent, secure, and user-centered cryptocurrency environment.