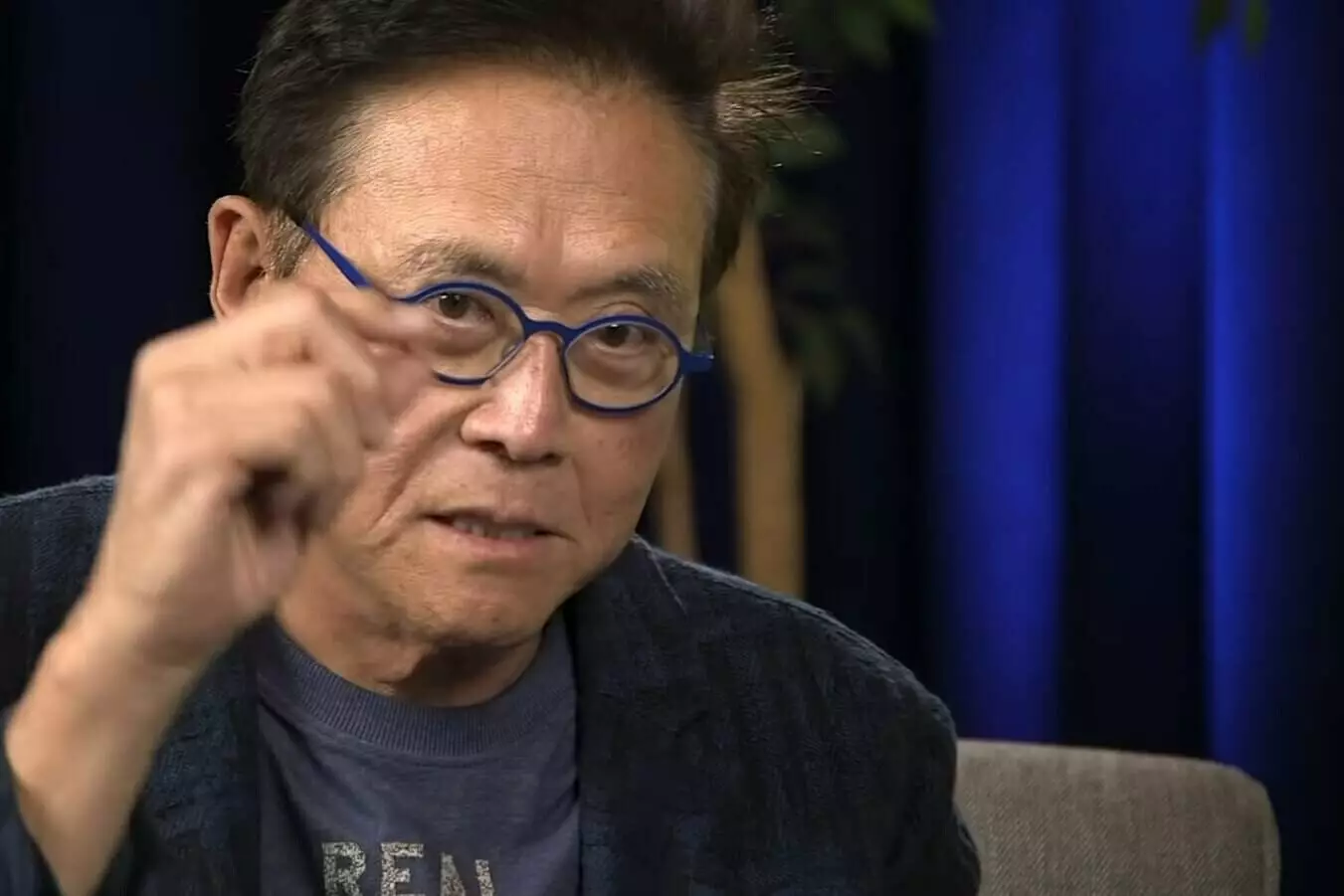

Renowned author Robert Kiyosaki, known for his personal finance book “Rich Dad Poor Dad,” has recently voiced his pessimism about the future of the US dollar. This comes as reports of BRICS nations planning to introduce a gold-backed currency become more prominent. Kiyosaki’s belief in the impending “death” of the US dollar coincides with his prediction of Bitcoin skyrocketing to $120,000 per coin.

Kiyosaki’s forecast for Bitcoin aligns with a recent prediction made by Standard Chartered, a global bank. They projected that Bitcoin would reach $100,000 by April. Kiyosaki has consistently advocated for precious metals and Bitcoin as alternatives to traditional government currencies. His dramatic predictions about the US economy and financial system have garnered attention over the years.

While some of Kiyosaki’s more extreme predictions have not come to fruition, his lack of confidence in the US dollar resonates with a growing sentiment, particularly within the cryptocurrency community. Arthur Hayes, co-founder of BitMEX, has suggested that the world may witness the fragmentation of multiple currency blocs due to inflationary pressures on the US dollar. Jeremy Allaire, CEO of Circle, has also highlighted the active process of de-dollarization, attributing it to declining trust in the US banking system.

Even former US President Donald Trump, who was initially skeptical about Bitcoin, predicted the loss of the dollar’s status as the world reserve currency. Trump acknowledged the declining value of the US currency and stated that it would represent a significant defeat after two centuries of dominance. Statements like these from influential figures contribute to the increasing concern over the US dollar’s future.

Throughout this year, there have been indications that countries are gradually moving away from relying on the US dollar for global trade. For instance, in March, Chinese and French energy companies agreed to settle a liquefied natural gas deal using the Chinese Yuan (CNY). Additionally, Brazil and China signed a trade agreement to use their respective currencies instead of the US dollar. These changes further emphasize the shift away from the US dollar as the dominant global currency.

The decline of the US dollar as the dominant global currency is not a new concept. However, recent developments and prominent figures expressing their doubts about the dollar’s future have brought renewed attention to this issue. The reported agreement among BRICS nations to establish a gold-backed currency reinforces the notion that the position of the US dollar may be weakening.

As uncertainty surrounding the US dollar continues to grow, alternative assets like Bitcoin and precious metals are gaining traction as potential safe-haven investments. Bitcoin’s decentralized nature and limited supply make it an attractive option for investors seeking to hedge against the devaluation of traditional currencies. With increasing momentum behind the de-dollarization movement, the future of global finance appears to be entering a new era.

The pessimistic outlook on the US dollar’s future expressed by experts like Robert Kiyosaki, along with the shifting dynamics of global trade and the rise of alternative assets, raises valid concerns about the longevity of the dollar’s status as the dominant global currency. While the future remains uncertain, it is clear that the financial landscape is evolving, and investors are actively seeking alternatives to traditional government currencies. As the world watches the developments unfold, only time will reveal the true extent of the US dollar’s decline and the subsequent impact on the global economy.