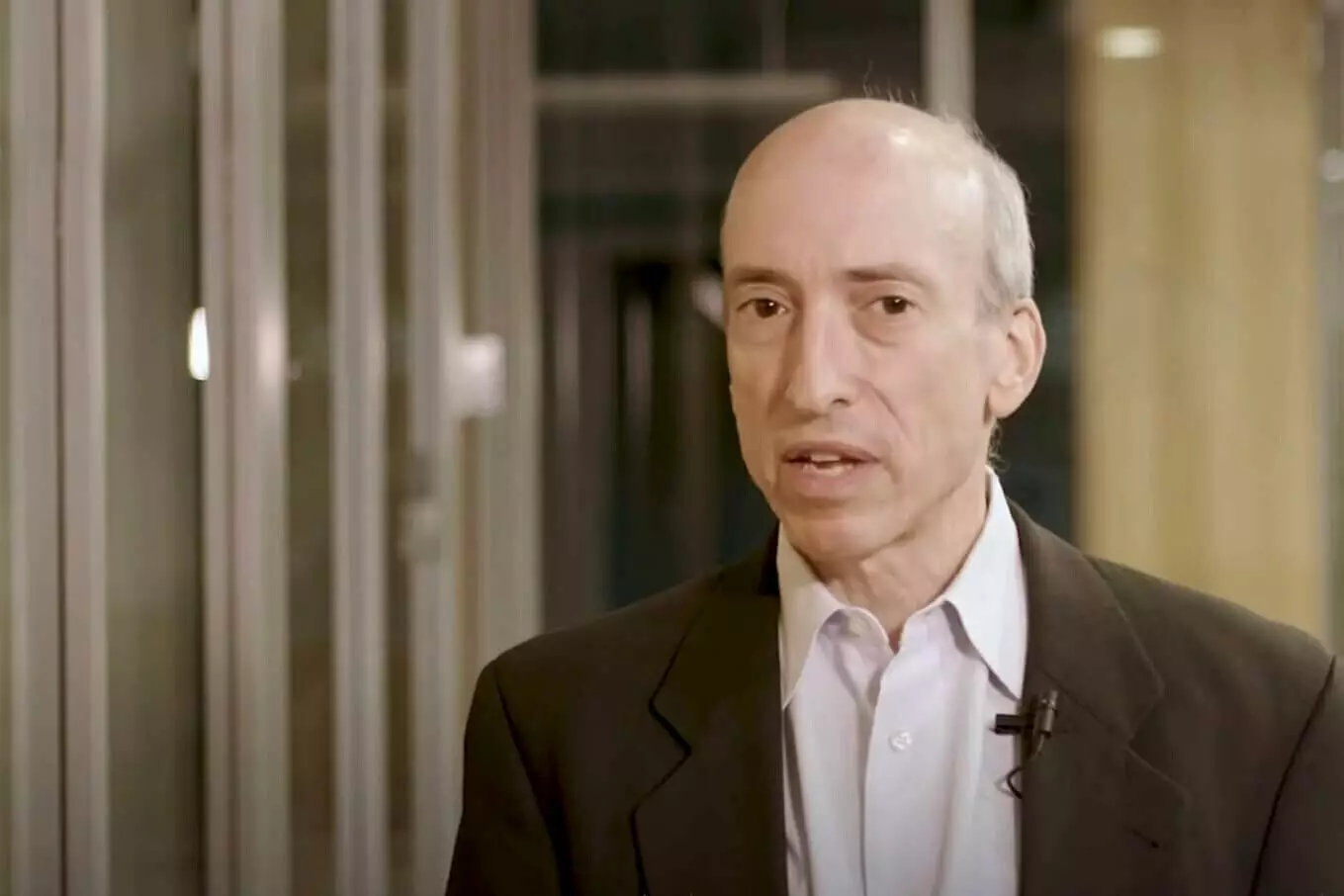

The recent court ruling declaring Ripple’s XRP token as “not in and of itself” a security has left Securities and Exchange Commission (SEC) chair, Gary Gensler, disappointed. Speaking at an event in Washington DC, Gensler expressed his concern for retail investors while acknowledging the protection afforded to institutional investors by the ruling.

The court ruling stated that the classification of XRP as an “investment contract” or security is not automatic, but rather depends on the specific context in which it is used. This clarification adds a layer of complexity to the regulation of XRP and other tokens in the cryptocurrency industry. It highlights the need for careful analysis of each token’s characteristics and function.

One significant aspect addressed in the ruling is the recognition that Ripple’s “programmatic” sales of XRP, which involve the use of trading algorithms to sell tokens on exchanges, do not constitute a securities offering. This distinction is important as it exempts Ripple from certain regulatory requirements that would otherwise apply to traditional securities offerings.

Despite his disappointment with the court ruling, Gensler reiterated the SEC’s commitment to regulating and cleaning up the cryptocurrency industry in the United States. The SEC aims to bring non-compliant firms into compliance without making any prejudgments. The overarching goal remains the protection of the investing public and fostering a safer environment for cryptocurrency transactions.

Coinciding with Gensler’s comments, the ongoing legal battle between Ripple and the SEC took an interesting turn as the remaining issues were referred to Magistrate Judge Sarah Netburn. Judge Netburn has previously ordered the unsealing of the Hinman documents, which played a significant role in Ripple’s favorable ruling. Her involvement adds a new dimension to the case and raises anticipation for the outcome of the legal proceedings.

As the legal battle continues and regulatory authorities like the SEC grapple with the complexities of the cryptocurrency industry, the regulatory landscape for cryptocurrencies will undoubtedly evolve. The court ruling on XRP classification, along with the ongoing legal proceedings, will shape the future framework for cryptocurrencies in the United States. It is crucial for both regulators and industry participants to navigate these complexities to ensure the growth and stability of the sector.

While SEC Chair Gary Gensler expressed disappointment in the court ruling regarding Ripple’s XRP token, his focus remains on protecting investors and ensuring compliance within the cryptocurrency industry. The ruling clarified the context-dependent nature of XRP’s classification and recognized Ripple’s programmatic sales of XRP as not constituting a securities offering. With the involvement of Magistrate Judge Sarah Netburn, the legal battle between Ripple and the SEC takes on a new dimension. The unfolding of these events will undoubtedly shape the regulatory landscape for cryptocurrencies in the United States.