The ongoing lawsuit between the Securities and Exchange Commission (SEC) and Ripple Labs has reached another critical juncture as the SEC files an appeal against a recent ruling that had mixed implications for the case. The complexities surrounding this high-profile dispute are emblematic of the broader challenges facing cryptocurrency regulation in the United States. As Ripple continues to defend its position, the implications of this legal battle extend beyond the corporate entities involved, impacting the cryptocurrency market at large.

Background of the Legal Battle

The SEC initiated its legal action against Ripple Labs in December 2020, accusing the firm of conducting an unregistered $1.3 billion securities offering via the sale of its digital asset, XRP. The regulatory body argues that XRP should be classified as a security, subject to the same stringent regulations as stocks and bonds. Ripple’s founders, however, contend that XRP functions as a utility token within the blockchain ecosystem, which challenges the SEC’s claims. This dichotomy highlights the lack of clear regulatory guidelines governing digital assets, creating a climate of uncertainty for companies operating in the cryptocurrency space.

In August 2023, U.S. District Judge Analisa Torres issued a ruling that provided some clarity. While she concluded that Ripple’s direct sales of XRP to institutional investors had violated securities laws, she also determined that programmatic sales to retail investors did not fall under the same category. This nuance allowed Ripple to celebrate parts of the ruling as a win, fostering hopes within the crypto community for a more favorable regulatory framework. However, the SEC’s decision to appeal indicates the lingering contention between the agency and cryptocurrency entities.

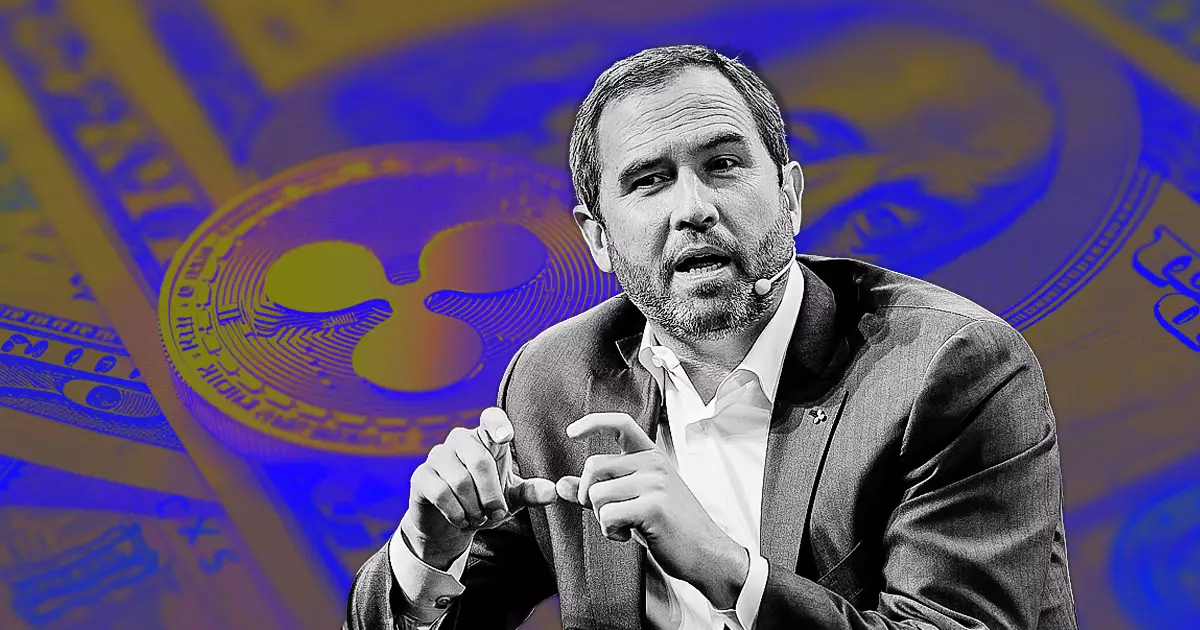

Ripple executives, including CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty, expressed their frustration with the SEC’s decision to escalate the legal proceedings. They characterized the agency’s appeal as an unnecessary waste of resources, particularly when key aspects of the case have seemingly resolved in Ripple’s favor. In statements made following the lawsuit’s developments, Garlinghouse pointed out that compared to the larger $2 billion fine initially sought by the SEC, the resulting penalty of $125 million felt more like an acknowledgment of Ripple’s position rather than a decisive victory for the regulator.

Ripple’s leaders argue that the SEC has consistently failed to provide clear guidance on crypto regulations, choosing instead to engage in what they term “litigation warfare.” This criticism underscores a pervasive sentiment within the cryptocurrency industry that the regulatory environment is stifling innovation. Alderoty further highlighted the court’s acknowledgment that there were no “victims or losses” involved in the case, emphasizing the need for regulatory bodies to adapt to the evolving landscape of digital finance.

The SEC’s announcement of its appeal was met with a swift decline in XRP’s market value, exacerbating uncertainty among investors and traders. In a matter of hours, XRP’s price fell approximately 9% to a trading value of just above $0.54. Such volatility illustrates how regulatory actions can directly affect market sentiment, a reality that cryptocurrencies are particularly susceptible to given their relatively nascent status. As of early October 2024, XRP is ranked seventh in terms of market capitalization, indicating that investor confidence remains fragile amid the ongoing legal saga.

Despite the immediate fallout in XRP’s trading price, Garlinghouse asserts that Ripple remains steadfast in its legal position. He firmly believes that the classification of XRP as a non-security stands firm under current law, regardless of the appeal process initiated by the SEC. This confidence can also be seen as Ripple’s broader commitment to maintaining its place within the cryptocurrency ecosystem, demonstrating resilience in the face of adversity.

The Broader Implications for the Crypto Industry

The SEC’s ongoing dispute with Ripple Labs holds significant implications for the overall direction of cryptocurrency regulation in the United States. If the SEC succeeds in its appeal, it may establish precedent that could impact not only Ripple but also other companies operating within the digital asset sphere. Conversely, if Ripple continues to win rounds in court, it could inspire greater confidence and innovation among crypto firms, potentially steering the regulatory conversation in a more favorable direction.

As the crypto market remains instrumental in shaping the financial landscape, the outcomes of legal battles like this one will be crucial in determining future regulatory frameworks. Stakeholders, regulators, and investors must remain vigilant as the complexities of cryptocurrency oversight continue to unfold. The outcome of the SEC and Ripple’s high-stakes confrontation may indeed have lasting effects on how digital assets are viewed and regulated in years to come.