As the Bitcoin price retraces higher, reaching $37,422 with a 4.2% increase in the past 24 hours, investors are optimistic about its future. With year-to-date gains of 123%, Bitcoin has outperformed all other asset classes, sparking anticipation for even greater profits with the eventual approval of a spot Bitcoin ETF. Despite recent news of a deferred decision by the US Securities and Exchange Commission (SEC) on the first spot Bitcoin ETF application, traders remain bullish on the cryptocurrency.

Bitcoin Minetrix: A Unique Crypto Asset

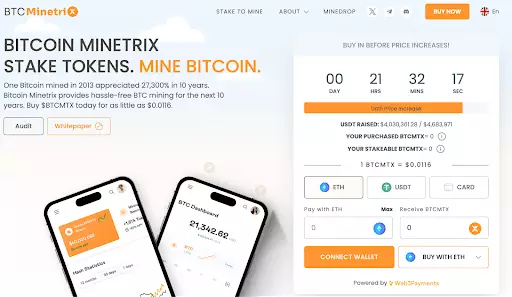

Bitcoin Minetrix ($BTCMTX), a stake-to-mine Bitcoin alternative, has garnered significant attention and investment, surpassing $4 million in its presale. Built on the Ethereum blockchain, Bitcoin Minetrix offers users the opportunity to mine Bitcoin by staking the native $BTCMTX token. This innovative approach provides several advantages over traditional cloud mining models, including ease of use, low entry cost, and increased security against scammers. With the market’s growing interest in alternative investment propositions, Bitcoin-related coins like Bitcoin Minetrix have become highly sought after.

Experts forecast that the Bitcoin price may reach multiples of $100k, considering its current upward trajectory. A crucial indicator, the market value to realized value ratio (MVRV), suggests that Bitcoin holders are profiting from their investments, signifying a transition from the bear to the bull cycle. As the market matures, new tokens such as Bitcoin Minetrix present an attractive opportunity for investors to ride the bull cycle and capitalize on potential gains.

BlackRock’s recent announcement of its application to launch a spot Bitcoin ETF marks a significant milestone for the crypto industry. As the world’s largest fund manager with $8.54 trillion in assets under management, BlackRock’s endorsement of Bitcoin as “digital gold” brings credibility and attracts billions of dollars into the crypto space. Financial advisors and pension fund managers, previously hesitant to invest in Bitcoin due to regulatory constraints, will now have a regulated route into the asset class. A spot Bitcoin ETF approval could revolutionize the market and position Bitcoin as a legitimate investment option.

The Seismic Impact of a Spot Bitcoin ETF

The launch of a spot Bitcoin ETF in the largest capital market, the United States, has the potential for a seismic impact on the asset class. With the combined valuation of the US equity and fixed-income ETF sector at $7 trillion and the total US equity market valued at $44 trillion, the inflow of billions of dollars into Bitcoin would significantly reshape the industry. The credibility gained through a spot Bitcoin ETF approval would attract institutional investors and pave the way for further growth and innovation in the crypto market.

Bitcoin Minetrix: A Promising Option for Investors

Bitcoin Minetrix stands out as one of the top candidates for Bitcoin alternatives due to its unique offering of capital and income growth. By owning the $BTCMTX coin, investors benefit from the overall Bitcoin investment story, while also receiving mining rewards as income. Additionally, Bitcoin mining remains highly profitable, especially for tokenized cloud miners in the Bitcoin Minetrix ecosystem who eliminate the expenses associated with mining rigs. As the number of Bitcoin wallet addresses valued at over $1 million grows alongside the increasing price of Bitcoin, the demand for alternative coins like Bitcoin Minetrix is likely to surge.

The Supply Shock Thesis Supports Bitcoin’s Rise

Further evidence supporting Bitcoin’s upward trajectory lies in the declining balances of Bitcoin on exchanges, which have reached a five-year low. This phenomenon adds weight to the supply shock thesis, suggesting a decrease in available Bitcoin for trading. With limited supply and growing demand, Bitcoin’s value becomes more likely to appreciate, making it an attractive investment option.

The ongoing surge in the Bitcoin price has reignited investor interest and anticipation for further gains. Amidst this fervor, Bitcoin Minetrix has emerged as a unique and promising alternative to traditional Bitcoin investments. With its innovative stake-to-mine model and the potential of a spot Bitcoin ETF approval, Bitcoin Minetrix offers investors the opportunity to participate in the bullish momentum of the crypto market while increasing their earnings. As the crypto industry continues to evolve, Bitcoin Minetrix represents a compelling option for both experienced and novice investors seeking exposure to the growing Bitcoin ecosystem.