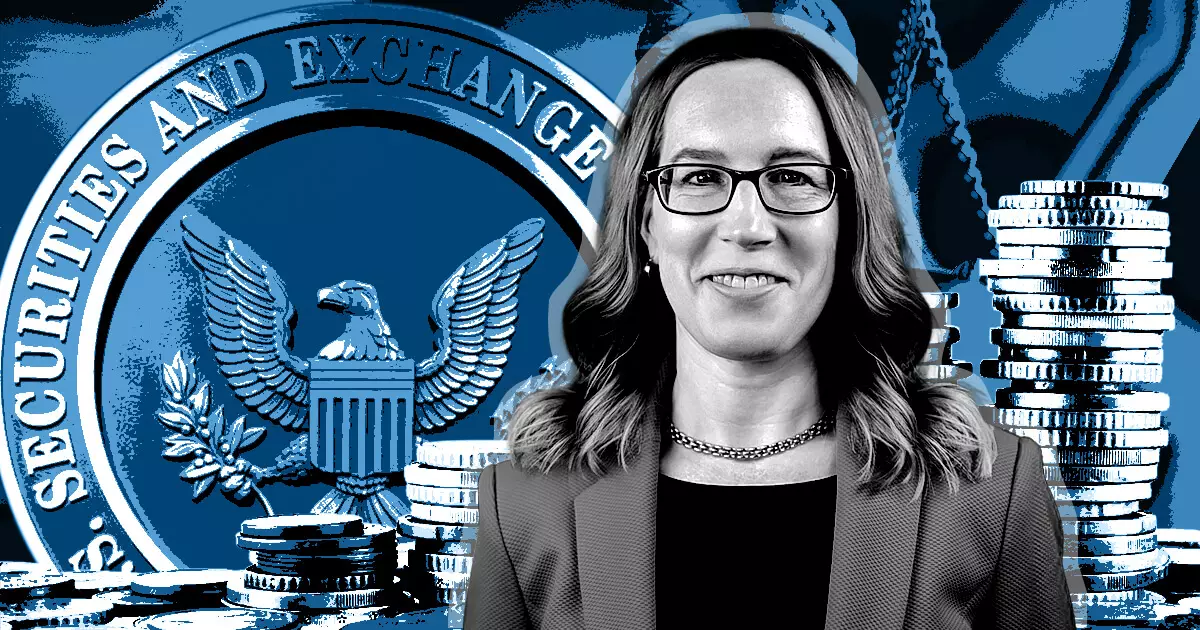

In a recent case against LBRY, Hester Peirce, a commissioner for the U.S. Securities and Exchange Commission (SEC), expressed her dissenting opinion on the agency’s actions. LBRY Inc., the company behind the LBRY blockchain and content-sharing network, decided not to appeal its loss in the case and instead announced that it would shut down and enter receivership to pay off its debts. Peirce, however, questioned the value of this outcome and criticized the SEC’s approach to regulation in the crypto sector.

Peirce highlighted the devastating consequences of the SEC’s litigation on LBRY, a company that had successfully built a functioning blockchain with a real-world application. She questioned whether investors and the market are truly better off now that the SEC’s actions have contributed to the demise of a promising project. This case serves as a disheartening example of the arbitrariness and real-life implications of the SEC’s enforcement approach towards the crypto industry.

It is important to note that the SEC did not allege any fraud committed by LBRY. Unlike many other projects, LBRY had fulfilled its promises. The project had a functional blockchain and an operational and popular content-sharing platform. Peirce criticized the SEC for taking an extremely hardline stance, seeking exorbitant penalties and demanding the destruction of LBRY’s tokens, without any assurance that these measures would prevent future violations of registration rules. The agency later reduced its penalty request, but the damage had already been done.

Peirce also expressed concerns about the lack of clarity in the application of securities laws to token projects. Despite the SEC’s claims, there is no clear path for companies like LBRY to register their functional token offerings. This ambiguity in regulation hampers innovation and discourages new projects from entering the market. The SEC’s scorched-earth tactics and disproportionate reaction to LBRY’s case only serve to stifle future blockchain experiments.

Peirce criticized the SEC for its misplaced priorities and misuse of resources. Instead of spending time and energy on a case that ultimately resulted in the shutdown of a promising project, the agency could have focused on creating a regulatory framework that fosters innovation and protects investors. By diverting its attention away from constructive regulation, the SEC risks impeding the growth of the entire industry.

Notably, the judge did not rule on the security status of LBRY’s token itself (LBC) or the secondary sales of LBRY, leaving room for the possibility of the blockchain’s continuation. While this ruling provides a glimmer of hope for LBRY, the damage caused by the SEC’s actions is difficult to overlook.

Hester Peirce’s dissenting opinion sheds light on the flaws and consequences of the SEC’s approach to regulation in the crypto sector. The excessive penalties and lack of clarity inhibit innovation and deter potential market entrants. It is crucial for regulatory agencies to strike a balance between investor protection and fostering technological advancements. Without a more thoughtful and measured approach, the SEC’s actions will continue to hinder progress and impede the growth of the crypto industry.