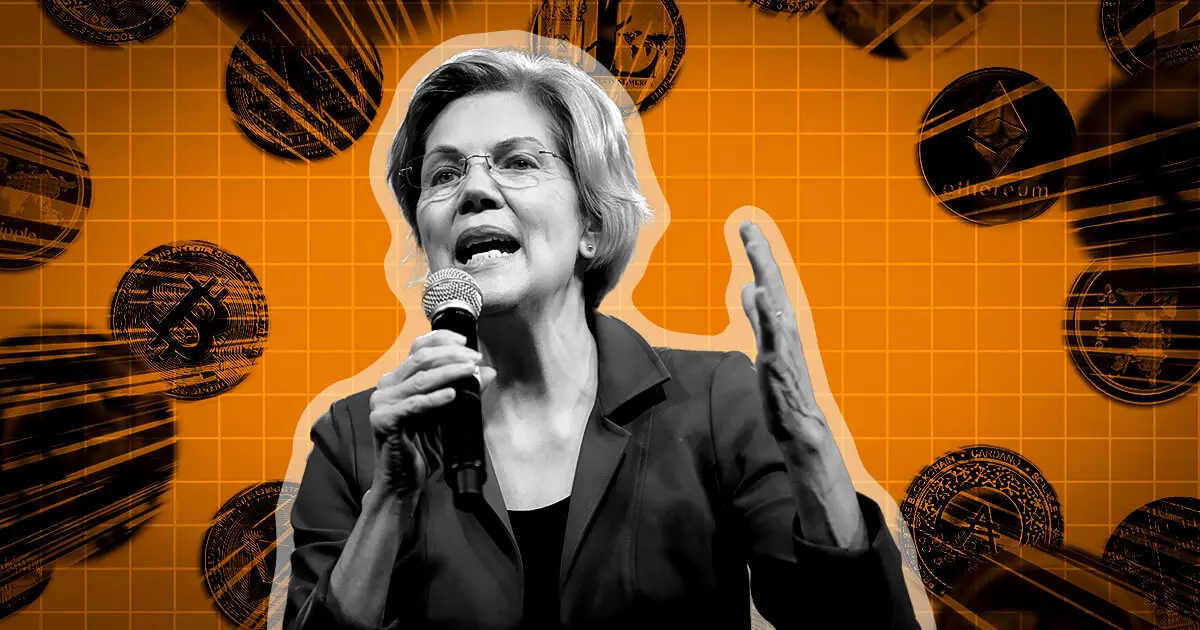

Cryptocurrency has become a significant player in the financial world, with a market capitalization of over $2 trillion. However, its rapid rise has exposed several loopholes, particularly in terms of tax reporting. The US government, in an attempt to address the estimated $50 billion crypto tax gap, enacted the Infrastructure Investment and Jobs Act (IIJA) almost two years ago. The legislation mandated the implementation of improved tax reporting practices for digital asset brokers. However, senators, led by Elizabeth Warren, are now urging the Treasury Department and IRS to expedite the process.

Delayed Implementation

The letter sent by the senators to Treasury Secretary Janet Yellen and IRS Commissioner Daniel Werfel expresses concerns about the failure to meet the congressionally-mandated deadlines for implementing final rules. Despite the law being enacted nearly two years ago, with a deadline of January 1, 2024, the proposed rules have yet to be published. This delay raises questions about the agencies’ ability to enforce robust tax reporting rules for cryptocurrency brokers.

The IIJA was introduced in response to the significant tax gap in the United States, which reached $1 trillion. The emerging and lightly-regulated cryptocurrency sector contributed to this problem. The anonymity associated with crypto transactions posed a detection challenge, enabling tax evasion and illegal activities. A May 2021 Treasury report supported the need for improved tax reporting rules, highlighting the risks posed by crypto transactions. Therefore, the senators’ demand for swift implementation gains further relevance.

Implications for the Crypto Ecosystem

The new rules introduced by the IIJA have profound implications for the crypto ecosystem. Third-party brokers facilitating crypto transactions will be obligated to report information related to users’ crypto sales, gains or losses, and certain large transactions to the IRS and the users themselves. This move aims to simplify the tax filing process for crypto users and enhance the IRS’s ability to combat large-scale tax evasion. Additionally, it is estimated that these rules can generate approximately $1.5 billion in tax revenue in 2024 alone and nearly $28 billion over the next eight years.

The senators’ letter emphasizes the urgency of implementing these rules by December 31, 2023. They highlight that failure to do so could result in a loss of an estimated $1.5 billion in tax revenue in 2024. This loss would significantly impact government resources and hinder efforts to address the crypto tax gap. Therefore, it is crucial for the Treasury Department and IRS to take swift action to avoid such consequences.

The push for implementing tax reporting rules comes at a time when Wall Street banks are supporting Elizabeth Warren’s Digital Asset Anti-Money Laundering Act. This proposed legislation aims to impose bank-like standards and requirements on crypto businesses. It is evident that the regulatory landscape for the crypto industry in the US is becoming more stringent, with a growing emphasis on traceability, oversight, and visibility.

There is an urgent need to implement tax reporting rules for cryptocurrency brokers in the US. The IIJA, enacted nearly two years ago, aims to address the significant crypto tax gap and streamline the tax reporting process for crypto users. The delay in publishing the proposed rules raises concerns about the agencies’ ability to meet the congressionally-mandated deadlines. Swift action is necessary to ensure the collection of an estimated $1.5 billion in tax revenue in 2024 and to enhance the government’s efforts to combat tax evasion in the crypto industry. Moreover, the increasing regulatory landscape highlights the importance of traceability, oversight, and visibility in the cryptocurrency market.