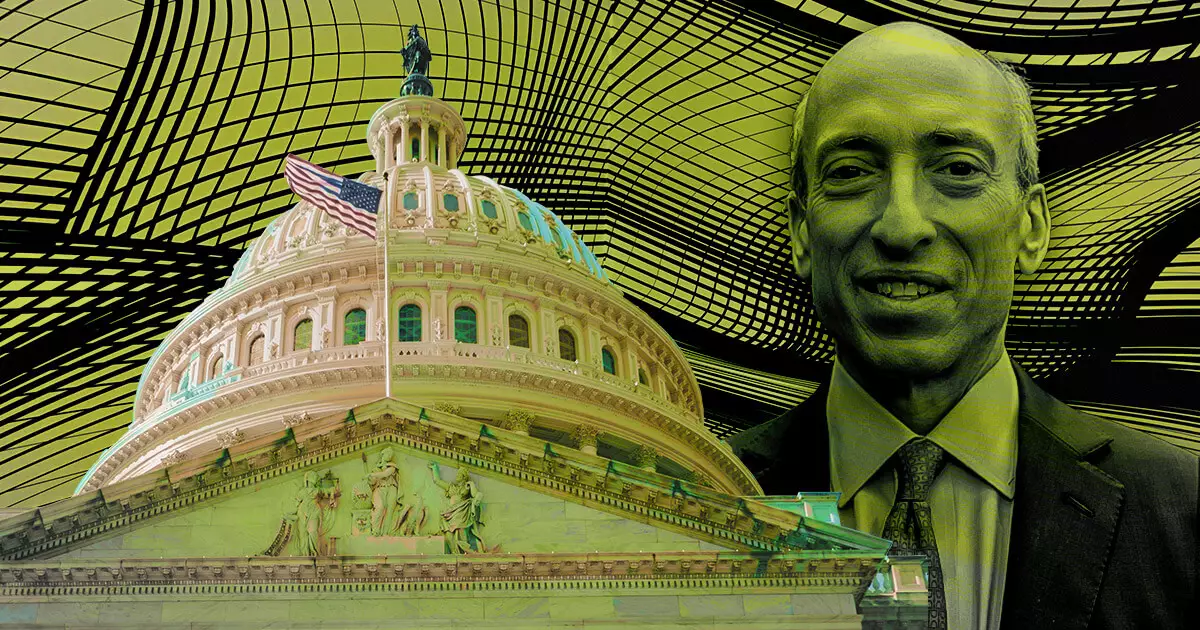

In a surprising turn of events, U.S. Congressman Warren Davidson, backed by House Majority Whip Tom Emmer, has taken a bold stance by advocating for the termination of SEC Chair Gary Gensler in 2024. Their rationale stems from allegations of corruption and abuses of power within the Securities and Exchange Commission (SEC). This move comes amidst growing tensions between the SEC and the digital asset sector over the course of 2023. Congressman Davidson firmly believes that Gensler’s enforcement-oriented regulatory approach has strained the relationship between the SEC and the digital asset industry.

To address these concerns, Congressman Davidson introduced the SEC Stabilization Act earlier this year. The proposed act aims to restructure the SEC and remove Gary Gensler from his position as Chair. It cites a series of alleged abuses committed under Gensler’s leadership. The proposed restructuring includes the addition of a sixth commissioner and an Executive Director to oversee day-to-day operations. However, all rulemaking, enforcement, and investigation powers would still rest with the commissioners. The primary goal of this restructuring is to prevent a single political party from holding more than three commissioner seats, thereby protecting U.S. capital markets from potential political biases and agendas.

Congressman Davidson stresses the urgent need for reform and unequivocally states, “U.S. capital markets must be protected from a tyrannical Chairman, including the current one. It’s time for real reform and to fire Gary Gensler as Chair of the SEC.” He asserts that a change in leadership is necessary to restore trust and ensure fair and consistent oversight that prioritizes the interests of American investors and the industry as a whole, rather than being influenced by political maneuvering.

Congressman Emmer, in solidarity with Davidson, emphasizes the importance of clear and consistent oversight to safeguard the interests of American investors and maintain a level playing field. Various supporters on social media echo these sentiments and express their support for Gensler’s removal and the passage of the SEC Stabilization Act. One notable tweet calls for an end to the accredited investor rule, arguing that it perpetuates the interests of a privileged class. Another tweet accuses Gensler’s SEC of favoring Wall Street over Main Street and endorses Congressman Davidson’s bill as a means to hold the SEC accountable.

The proposed SEC Stabilization Act and the heightened debate surrounding the potential firing of SEC Chair Gary Gensler mark a significant turning point in the ongoing discussion about regulatory approaches and accountability within the U.S. financial regulatory framework. It raises important questions about the balance between enforcement and nurturing innovation within the digital asset sector and the potential for political agendas to influence regulatory decisions.

As the dialogue continues, it is essential to carefully consider the implications of any proposed reforms to the SEC when it comes to safeguarding the interests of American investors and fostering an environment that promotes fair and transparent capital markets. It remains to be seen how this debate will unfold and what impact it will have on the future direction of financial regulation in the United States.