The stablecoin regulation bill introduced by U.S. Senators Cynthia Lummis and Kirsten Gillibrand has sparked significant interest and debate within the cryptocurrency community. With the impending announcement of this bill, many stakeholders are eager to see how it will impact the industry as a whole.

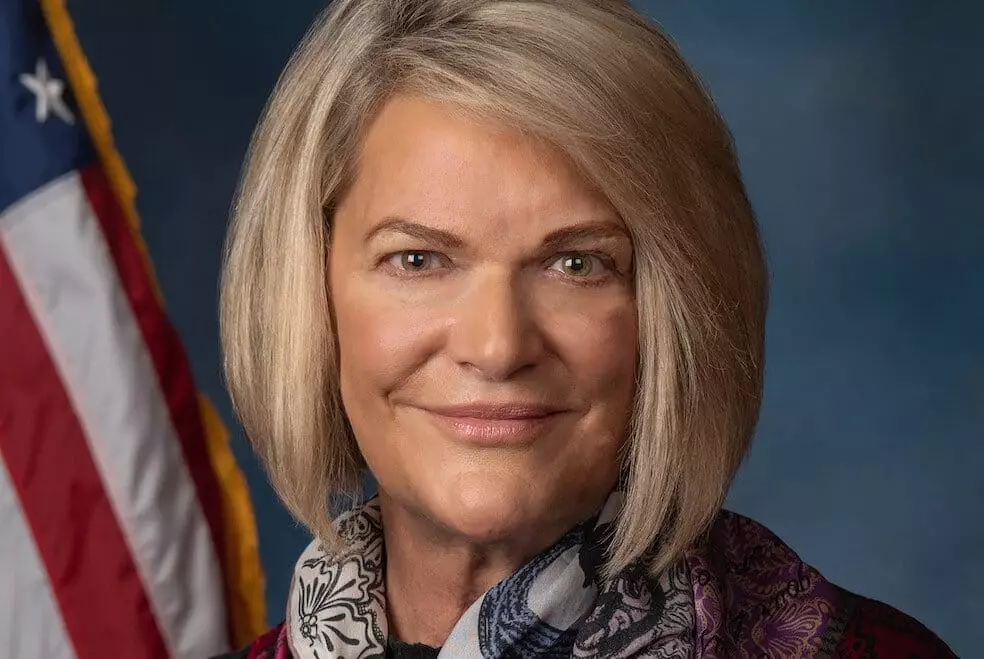

Sen. Cynthia Lummis’ Stance on Bitcoin and Stablecoins

Senator Lummis is known for her strong support of Bitcoin and her belief in its potential to revolutionize the government’s daily operations. However, her views on stablecoins, particularly Tether, have been more cautious. Lummis has been vocal about the potential risks associated with stablecoins and has even called for criminal charges against certain platforms for their alleged involvement in illicit financing.

While Senator Lummis and Senator Gillibrand are pushing for stablecoin regulation, Federal Reserve Chairman Jerome Powell has remained non-committal on the issue of a central bank digital currency (CBDC). Powell has emphasized that the U.S. is not yet ready to introduce a CBDC, signaling a more cautious approach to digital currencies.

The International Landscape of CBDC Development

While the U.S. deliberates on stablecoin regulation and CBDCs, other countries have already made significant progress in this area. The UK, for example, is actively exploring the possibility of a digital pound, with regulators working together to develop a framework for its implementation. Similarly, China’s e-yuan and Hong Kong’s wholesale CBDC program are paving the way for digital currency adoption on a global scale.

As discussions around stablecoin regulation and CBDCs continue to evolve, it is clear that the landscape of digital currency is poised for significant change. The decisions made by lawmakers and regulators in the coming months will have a lasting impact on how cryptocurrencies and digital assets are integrated into traditional financial systems.

The stablecoin regulation bill and the ongoing discussions about CBDCs represent a critical moment in the development of digital currency. As stakeholders navigate the complexities of this evolving landscape, it is essential to consider the implications of these regulatory decisions on the future of finance and technology.